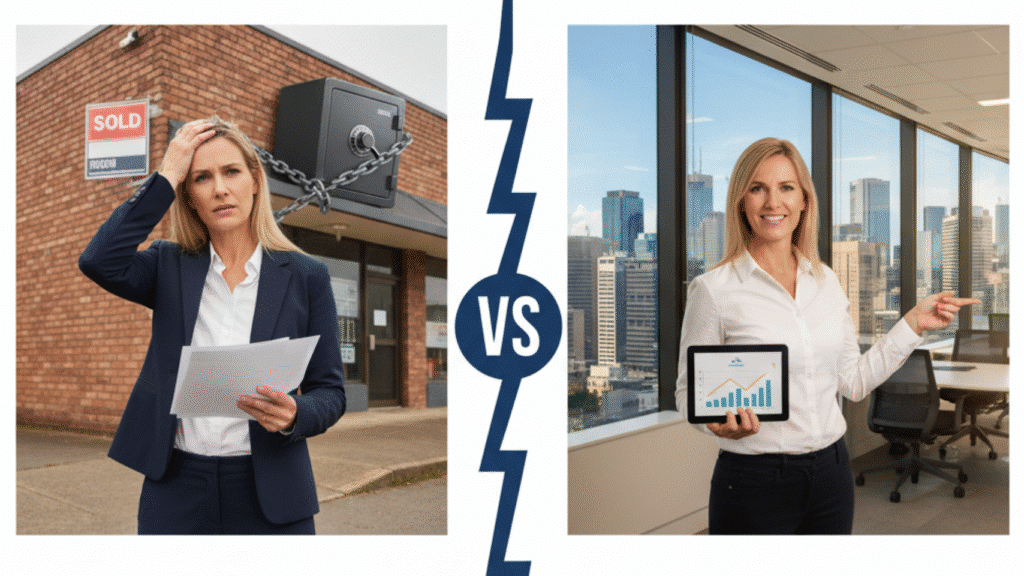

Enter Commercial Rentvesting in Australia – a strategy gaining traction, where you lease your business’s operating premises but invest in a separate commercial property for passive income and capital growth. This tactical approach offers a compelling alternative to outright purchasing your business’s location.

Let’s dissect the pros and cons to help you forge the optimal commercial property finance strategy for your SME.

Option 1: Outright Buying Your Business Premises

Pros:

- Equity Build-Up: Your business builds equity over time, increasing its asset value and potentially improving its valuation upon sale.

- Stability & Control: No landlord issues, no rent increases (beyond rates/outgoings), and full control over modifications and fit-out.

- Financial Leverage: The business can often use the property as collateral for future commercial finance (Target URL: /finance/) needs.

- Tax Benefits: Depreciation, interest on loans, and property expenses are generally deductible.

Cons:

- Capital Tie-Up: A significant portion of your business’s capital is locked in real estate, potentially limiting funds for core business growth, marketing, or inventory.

- Lack of Flexibility: Relocating the business if growth demands it can be a complex, costly, and time-consuming process.

- Market Risk: Property value fluctuations directly impact your business’s balance sheet.

- Ongoing Costs: Responsible for all maintenance, repairs, and property management.

Option 2: Commercial Rentvesting for Australian SMEs

Pros:

- Operational Flexibility: Easy to scale up or down, or relocate to a better area if your business needs change. Capital remains agile for core operations.

- Diversified Investment: Your property investment portfolio is separate from your operational business risk. You can invest in high-growth commercial areas without tying your business’s physical location to it.

- Lower Initial Capital Outlay: Frees up cash flow for business expansion, product development, or securing talent.

- Strategic Asset Acquisition: Allows you to leverage a Buyers Agent (Target URL: /buyers-agents/) to secure off-market, high-yield commercial investment properties separate from your business’s direct needs.

Cons:

- No Business Equity: Your business doesn’t build equity in its premises, potentially impacting its asset valuation.

- Landlord Dependency: Subject to lease terms, rent reviews, and the landlord’s decisions.

- Potential for Rent Increases: While predictable through lease terms, rent will generally increase over time.

Missed Capital Growth on Premises: If your business is in a rapidly appreciating area, you miss out on that specific property’s capital growth.

The Hybrid Approach: Leasing with a “Property Arm”

A popular strategy for SME property investment in 2025 is a blend: the business leases its premises from a separate, related entity (e.g., a family trust or SMSF) that owns the commercial property.

- Benefits: This offers the best of both worlds – the business gains stability from a favourable landlord (the related entity), while the owner enjoys the investment benefits (equity, tax advantages) in a separate, insulated structure.

- Considerations: Requires careful structuring and compliance with ATO regulations, especially if an SMSF is involved. Our Commercial Finance (Target URL: /finance/) specialists can guide you through the appropriate lending structures for such arrangements.

Making the Right Call for Your SME

The choice between Rentvesting and Buying is deeply personal and dependent on your business’s stage, growth projections, risk appetite, and long-term financial goals.

- Growth-Focused SMEs: May benefit from Rentvesting to keep capital liquid for rapid expansion.

- Established, Stable Businesses: Might lean towards buying for long-term stability and asset building.

- Strategic Investors: Utilise a Buyers Agent (Target URL: /buyers-agents/) to identify high-potential commercial investment properties for rentvesting, diversifying their portfolio while maintaining business agility.

Before making this critical decision, engage with specialists who understand both commercial finance and property acquisition. We can help you navigate the complexities, secure the right funding, and identify investment opportunities that align with your SME property investment 2025 strategy.

📞 Let’s chat about your next move.

🔗 www.thebrokerageconnection.com.au

📩 sales@thebrokerageconnection.com.au | 📱 1300 466 455